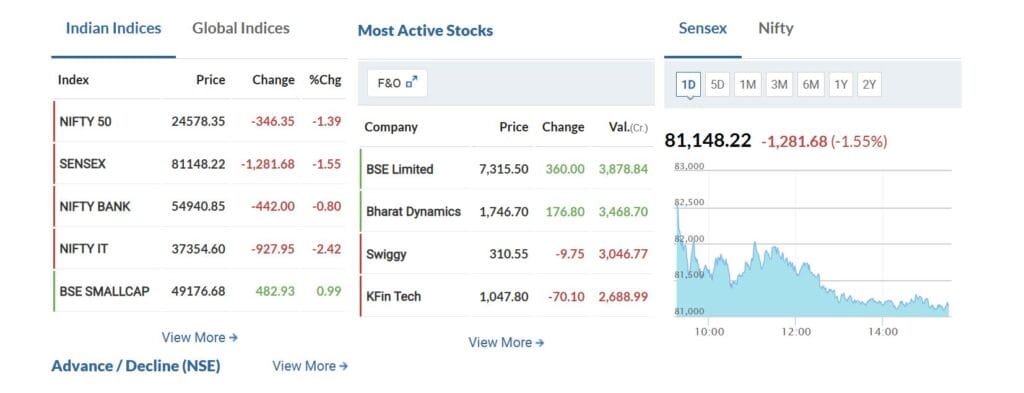

The Indian stock market witnessed a dramatic reversal on Tuesday, May 13, 2025, as benchmark indices Sensex and Nifty crashed sharply following their best session in over four years. The Sensex plummeted by 1,281.68 points (1.55%) to close at 81,148.22, while the Nifty50 dropped 346.35 points (1.39%) to settle at 24,578.

Key Reasons Behind the Sudden Market Crash

Escalating India-Pakistan Tensions

The primary driver of today’s market rout was heightened geopolitical risk after recent military escalations between India and Pakistan. Following a terrorist attack in Pahalgam, India launched ‘Operation Sindoor’, targeting terror centers in Pakistan and Pakistan-occupied Kashmir. Although both nations agreed to a ceasefire 51 hours later, investor sentiment remained fragile amid fears of further retaliation or instability.

Analysts noted that the uncertainty surrounding border tensions prompted investors to book profits and move to safer assets, especially after Monday’s euphoric rally.

Profit Booking After Record Rally

The crash came immediately after a historic surge on Monday, when the Sensex soared by 2,975 points (3.7%) and the Nifty by 916 points (3.8%). Such rapid gains typically trigger profit booking, as traders look to lock in gains amid rising uncertainty.

Sectoral Weakness

The sell-off was broad-based, with IT, Auto, FMCG, and Financial Services leading the decline-each falling over 1%. Notably, IT stocks like Infosys, HCL Tech, and TCS were among the top losers, with Infosys dropping 3.57%.

While large-cap indices suffered, midcap and smallcap stocks showed resilience, closing marginally higher.

Global and Domestic Economic Concerns

The bearish trend was also influenced by global cues. Despite positive moves in Asian markets and a surge on Wall Street overnight, Indian markets buckled under local pressures.

Investors were cautious ahead of the release of key macroeconomic data, including Consumer Price Index (CPI) and Index of Industrial Production (IIP) figures, which could influence monetary policy and market direction.

Market Impact and Investor Sentiment

The sharp fall wiped out nearly ₹3 lakh crore in investor wealth in a single session.

The India VIX, a measure of market volatility, edged down slightly, suggesting that while fear remains, panic selling was somewhat contained.

Experts advise investors not to panic, noting that the underlying market trend remains bullish and that such corrections are natural after steep rallies.

Summary Table: Key Indices Performance

| Index | Previous Close | Today’s Close | Change | % Change |

| Sensex | 82,429.90 | 81,148.22 | -1,281.68 | -1.55% |

| Nifty 50 | 24,924.70 | 24,578.35 | -346.35 | -1.39% |

Outlook

While today’s crash was triggered by a combination of geopolitical tensions, profit booking, and sectoral weakness, market experts suggest that investors remain vigilant but not overly alarmed. Corrections after sharp rallies are part of market cycles, and the broader economic fundamentals and policy direction will determine the medium-term trajectory.

“Investors remain cautious, fearing that any retaliation from Pakistan could further escalate the situation… But if such dips are held above 24,810, expect a resumption of uptrend.” –Anand James, Chief Market Strategist, Geojit Investments

Today’s sharp fall in the Indian stock market reflects a mix of geopolitical anxiety, profit-taking after a historic rally, and sectoral pressures. Market watchers will keep a close eye on further developments along the India-Pakistan border and upcoming economic data for cues on future direction.